Why November Is the Best Time to Sell in Arizona | Seller Strategy

🍂 Why November Could Be the Secret Best Time to Sell in Arizona Less competition. Serious buyers. A holiday-season advantage you can’t ignore. Most homeowners assume that the best time to sell is spring or early summer. But here’s the twist—November might actually give you the upper hand in Arizona

Lower Utility Bills Without Sacrificing Comfort | Arizona Home Energy ROI

How to Lower Utility Bills Without Sacrificing Comfort Smart energy solutions for Arizona homeowners: solar, insulation, and smart thermostats that pay off. Let’s be honest—keeping your Arizona home comfortable through triple-digit summers can be expensive. But here’s the good news: lowering your ut

What Move-In Ready Really Means to Arizona Buyers | Sold Realty Group

What “Move-In Ready” Really Means to Buyers Clarifying the difference between staged, updated, and truly turn-key homes. “Move-in ready.”It’s one of the most powerful phrases in real estate—but also one of the most misunderstood. For sellers, it’s a selling point.For buyers, it’s a promise.And somet

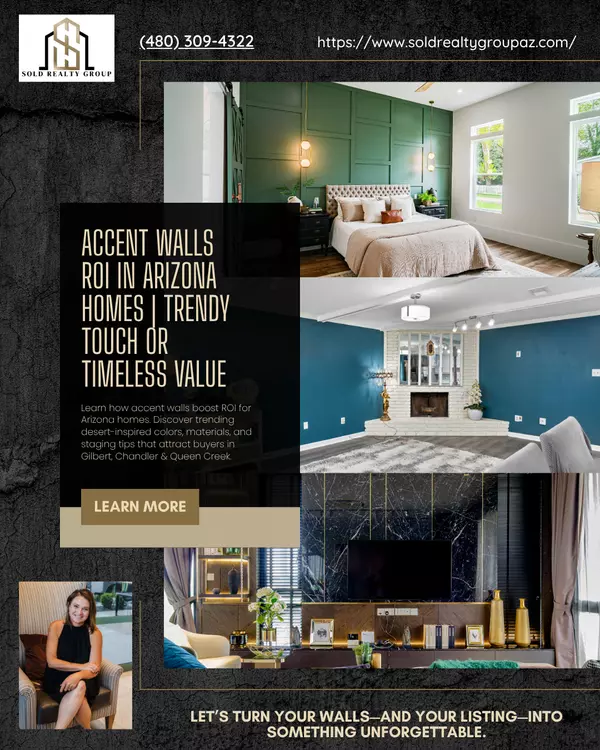

Accent Walls ROI in Arizona Homes | Trendy Touch or Timeless Value

🎨 Accent Walls: Trendy Touch or Timeless ROI? How a simple wall transformation can boost your home’s style—and its market value. When it comes to home upgrades that deliver big visual impact for little cost, few projects compete with an accent wall. Whether it’s a deep navy in the dining room, a mo

Categories

- All Blogs (243)

- 2026 Real Estate Tips (2)

- Arizona Real Estate & Local Market (20)

- AZ Market Insight & Education 2026 (1)

- Buying, Selling & Investing Tips (79)

- Home Improvement Ideas (40)

- HOME MAINTENACE TIPS (22)

- Home Selling Strategies (26)

- Legal & Financial Consideration (11)

- Listing (5)

- Living in Queen Creek (15)

- LIVING IN SANTAN VALLEY (12)

- Local Business Spotlight (2)

- Local Events & Activities (3)

- Question & Answers (1)

- Real Estate Education & Empowerment (8)

- SANTAN VALLEY (1)

- Sold Selling Method: Perception (5)

- Sold Selling Method: Presentation (5)

- Sold Selling Method: Price (3)

- Staging (14)

- Sustainability and Green Living (4)

Recent Posts